Excitement About Pvm Accounting

Excitement About Pvm Accounting

Blog Article

The 45-Second Trick For Pvm Accounting

Table of ContentsIndicators on Pvm Accounting You Need To KnowThe Ultimate Guide To Pvm AccountingThe Of Pvm AccountingGetting My Pvm Accounting To WorkThe Definitive Guide for Pvm AccountingWhat Does Pvm Accounting Do?

Supervise and take care of the development and authorization of all project-related payments to customers to promote excellent interaction and avoid problems. construction bookkeeping. Make certain that appropriate reports and documents are sent to and are updated with the IRS. Make sure that the accounting process follows the law. Apply called for construction audit standards and procedures to the recording and coverage of construction activity.Understand and keep conventional expense codes in the accountancy system. Interact with different funding companies (i.e. Title Company, Escrow Business) relating to the pay application procedure and requirements needed for repayment. Take care of lien waiver dispensation and collection - https://fliphtml5.com/homepage/dhemu/leonelcenteno/. Display and settle financial institution concerns consisting of cost abnormalities and inspect differences. Help with executing and preserving interior monetary controls and procedures.

The above statements are intended to describe the basic nature and degree of work being carried out by people assigned to this classification. They are not to be interpreted as an exhaustive checklist of duties, tasks, and skills required. Employees may be called for to carry out duties beyond their typical duties once in a while, as required.

Some Known Factual Statements About Pvm Accounting

You will help sustain the Accel group to make sure delivery of successful on schedule, on budget plan, projects. Accel is seeking a Building and construction Accountant for the Chicago Workplace. The Building and construction Accountant executes a range of accounting, insurance coverage conformity, and project management. Functions both independently and within particular divisions to keep financial records and ensure that all documents are maintained existing.

Principal duties consist of, but are not limited to, dealing with all accounting features of the company in a timely and accurate manner and offering reports and schedules to the company's CPA Firm in the preparation of all financial statements. Guarantees that all accountancy treatments and functions are handled precisely. In charge of all economic documents, payroll, banking and daily operation of the accountancy function.

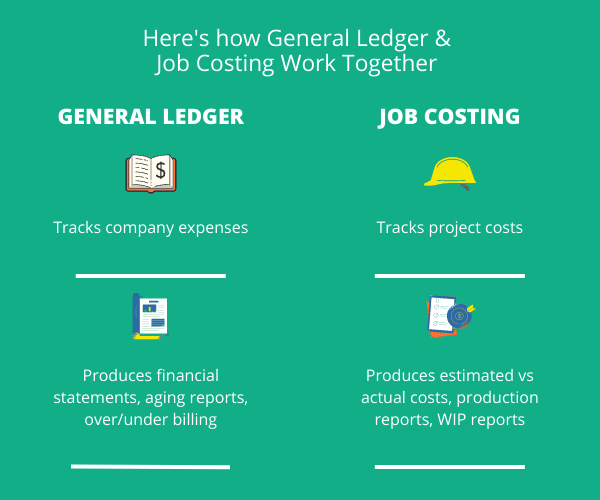

Functions with Job Managers to prepare and upload all regular monthly billings. Creates regular monthly Work Expense to Date records and working with PMs to reconcile with Project Managers' spending plans for each project.

7 Simple Techniques For Pvm Accounting

Efficiency in Sage 300 Building and Real Estate (previously Sage Timberline Workplace) and Procore building monitoring software application an and also. https://www.easel.ly/browserEasel/14478975. Have to likewise excel in other computer software application systems for the prep work of reports, spread sheets and other accounting analysis that might be called for by management. construction bookkeeping. Need to have solid business skills and ability to prioritize

They are the monetary custodians that ensure that building and construction tasks remain on budget, follow tax obligation regulations, and maintain financial transparency. Construction accountants are not just number crunchers; they are calculated companions in the building and construction procedure. Their key role is to manage the monetary elements of building and construction tasks, ensuring that sources are alloted efficiently and monetary dangers are decreased.

The Buzz on Pvm Accounting

By keeping a tight grasp on task financial resources, accountants assist protect against overspending and monetary troubles. Budgeting is a keystone of successful construction projects, and construction accountants are critical in this regard.

Navigating the complicated web of tax laws in the construction sector can be challenging. Construction accounting professionals are fluent in these policies and make sure that the task abides by all tax needs. This consists of managing payroll taxes, sales tax obligations, and any kind of other tax responsibilities certain to building and construction. To master the function of a building and construction accounting professional, individuals need a solid academic structure in accounting and finance.

In addition, accreditations such as Licensed Public Accountant (CERTIFIED PUBLIC ACCOUNTANT) or Licensed Construction Sector Financial Expert (CCIFP) are highly concerned in the sector. Building tasks often entail tight target dates, altering policies, and unexpected expenditures.

An Unbiased View of Pvm Accounting

Professional qualifications like certified public accountant or CCIFP are likewise extremely recommended to show expertise in building and construction audit. Ans: Building accountants develop and keep an eye on budgets, recognizing cost-saving possibilities and ensuring that the task stays within spending plan. They likewise track expenses and projection economic requirements to avoid overspending. Ans: Yes, building and construction accountants take care of tax compliance for building and construction projects.

Intro to Building Audit By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Construction companies have to make hard choices among several financial options, like bidding process on one project over one more, choosing funding for materials or equipment, or establishing a task's earnings margin. Construction is a notoriously unstable market with a high failing price, slow-moving time to settlement, and inconsistent cash flow.

Production includes duplicated processes with conveniently identifiable expenses. Production needs various procedures, materials, and equipment with varying prices. Each job takes area in a new place with differing website problems and distinct obstacles.

The Of Pvm Accounting

Constant usage of various specialty contractors and providers impacts efficiency and money flow. Settlement shows up in full or with regular settlements for the full agreement quantity. Some part of repayment may be kept till task conclusion also when the contractor's work is completed.

While typical producers have the benefit of regulated environments and enhanced manufacturing procedures, construction business have to continuously adapt to each brand-new task. Even somewhat repeatable jobs call for modifications due to you could try this out site conditions and various other variables.

Report this page